#ThePolicy - work or not?

As the Centre for Policy Studies (CPS) put it on their website: "Maurice Saatchi, the man behind the £10,000 income tax threshold, has delivered a revolutionary new tax Policy which will see small and medium-sized businesses (SMEs) pay no corporation tax and which will abolish capital gains tax for their investors"

And as the man himself writing in the Telegraph puts it: "The Policy, as I call it, would therefore abolish corporation tax for 90 per cent of UK companies, reduce the deficit faster than predicted by the Office for Budget Responsibility (OBR) , expand employment faster than it predicts, increase competition, challenge cartel capitalism and let millions of people grow tall"

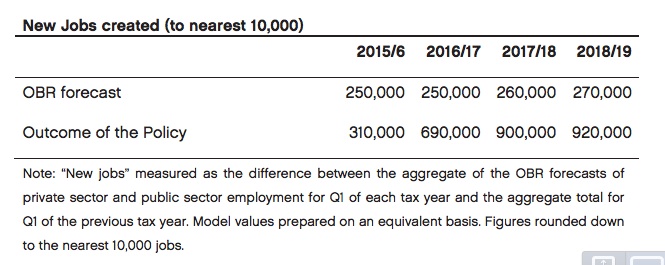

It's not made clear in the extensive paper for the CPS quite how The Policy might affect people's height, but on employment it's fairly unequivocal that over four years an extra 1.8m jobs could be created by small companies (those with up to 50 employees) applying tax savings to employ more people.

Figure #1

That's a lot of jobs in a very short space of time, and as the implication is that these are proper full-time employee jobs, to put it in perspective that's about the same number as created over the whole period between 1998 and 2014.

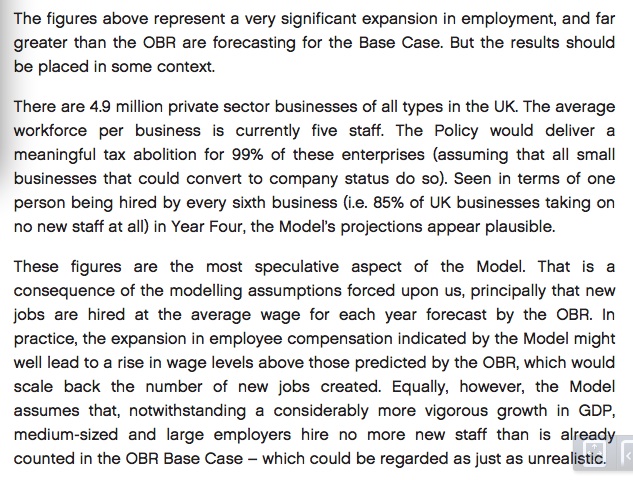

Benedcit Dellot from the RSA thinks that this must be too good to be true, and points to the relatively poor record of job creation among small businesses over recent years. Lord Saatchi is obviously aware that the claim might seem extravagant

Figure #2

I've had a closer look at the numbers to see just how speculation and plausibility in The Policy balance out to produce jobs.

The methodology in the paper is actually quite simple

- Calculate the total amount of tax potentially relieved for the small companies targetted

- Assume that nearly a third (31%) would be used for employing new people

- Work out how many jobs this would pay for at average wage

The answer is about 1.8 million new jobs over four years.

- Plausibility check by considering what proportion of businesses would have to take on new employees in a year.

The answer is that in year 4, just 1 in 6 businesses would have to take on a single new employee

A very large edifice is erected on this cornerstone, as of course the number of new jobs created and at what wage level is key to subsequent calculations of direct and indirect tax payments, expenditure on benefits etc etc.

However, mixing metaphors, there seem to be two weak links in the chain and one end is not secured.

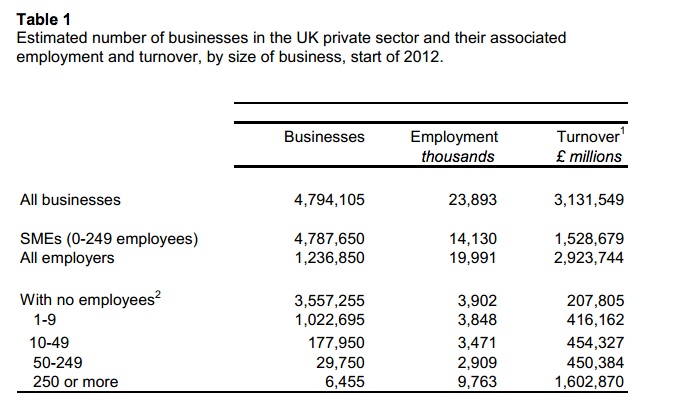

Firstly, it presumes that a third of tax savings are likely to be applied to employee earnings. While this might be observably true for the whole economy, there is no data or analysis to suggest that it true for all sectors of the economy, and in particular that it does not vary by size of business or number of employees (if any). Indeed, if additional employee earnings are presumed to be in fact earnings of additional employees (as they are in the paper), it cannot be true because three quarters of businesses don’t employ anyone at all. Further, while the average workforce per business over all businesses in around five people, among smaller businesses it is only a little over two people.

Figure #3 (from BIS)

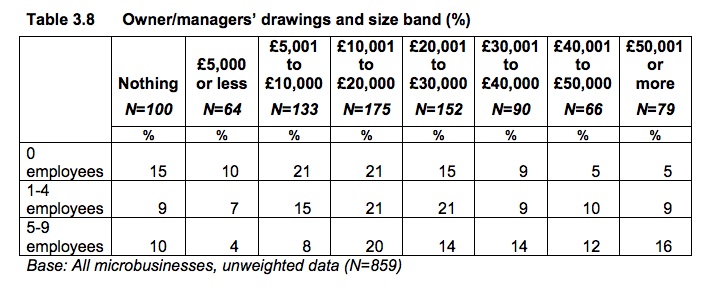

Secondly, there is a threshold cost to creating a new job at average wage which the tax savings for the vast majority of businesses will come nowhere near reaching, even if they put all of the savings towards the cost of a new employee rather than just 31%. Bearing in mind that the three quarters of all businesses who don’t employ anyone else at present have an average turnover of just over £50,000, and half of them take no more than £10,000 from the business, it’s clear that the abolition of a 20% tax on profits wouldn’t create many jobs at average wage when the majority of these businesses aren’t making enough to allow even a single average wage to be taken out of them already. Realistically, you need to be making taxable profits of £150,000 a year, and then recycle all of the corporate tax saving (not just 31% of it) into employee earnings to create a new job at average wage.

Figure #4 (from BIS)

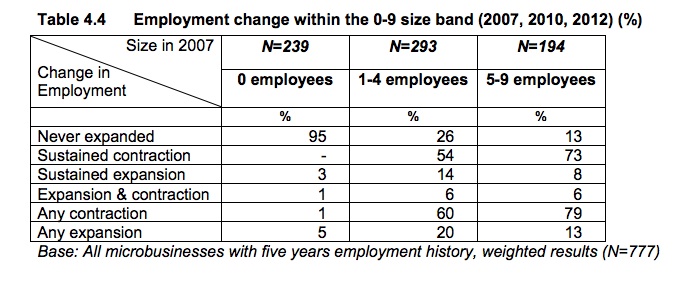

Thirdly, tugging the end of the chain, the plausibility check doesn’t really work. Of course one business in six employing one extra person in a year does sound quite reasonable. But the denominator for that equation includes all of those businesses who don’t employ anyone at the moment, and bearing in mind the previous two points aren’t likely to do so. BIS figures seem to confirm this by showing that from 2007 to 2012 only 5% of non-employing businesses moved on to employ someone over the whole period.

Figure #5 (from BIS)

If that were reproduced over the four year period of the model and each non-employee business becoming an employer took on 2 new employees on average (which is probably very generous), that would account for about 400,000 new jobs. But that would still leave 1.4m new jobs to be created by the remaining 1.2m small businesses. This changes the requirement to nearly one business in three employing one extra person a year over the four years. That still doesn’t seem too implausible until you look at how many people are already employed by these businesses – about 7.3 million as Figure #3 shows. So over 4 years, small businesses already employing people would have to expand their total employee numbers by 20%. That would seem to require quite implausible assumptions about demand in this sector in the context of the general economic growth forecast.

It would have been more interesting to see a breakdown of how the benefits are forecast to accrue to businesses of particular size - the plausibility check then being how many businesses get enough of a break to be able to employ someone new. Hundreds, thousands or even tens of thousands of pounds per business given to a very large number of small businesses not being capable of aggregation in the hands of any one potential employer will not create a new job.

It’s rather like saying that a tax break of £20 million could result in sales of 1,000 new cars at £20,000 each. Well yes if only 1,000 people benefited from the break and got £20,000 each. But if it were shared out around 100,000 people at only £200 each, no one gets enough to buy a new car.

For the vast majority of small businesses, abolition of corporate tax does not pay the wages of a new employee, and these businesses cannot realistically concentrate the money so as to do so. In terms of job creation, it would be more certain for the government simply to keep collecting the tax but offer to pay the entire cost of employing new people at the average wage. It would have a more certain outcome and be cheaper too, getting direct bang for buck rather than give 100% of the tax back and hope that a third of it goes to employing new people.

And finally, if a small company is making so much money that remission of 20% tax on its profits would pay for a new employee at average wage, it does rather beg the question of why they aren’t employing someone new already, as they can clearly afford to do so …

#ThePolicy ...

Centre for Policy Studies

Lord Saatchi's chef d'oeuvre with accompanying video and associated documents, spreadsheets etc here.

Benedict Dellot from the RSA

Benedict's doubts about #ThePolicy here

Adam Lent from the RSA

Small is powerful here

Steven Toft (@FlipChartRick)

Small is not powerful here