by email

More Rosy stuff

Another great spread of charts in the FT today from my near namesake Sarah O’Connor (actually my sister’s namesake), coinciding with the Prime Minister’s call on businesses to raise pay.

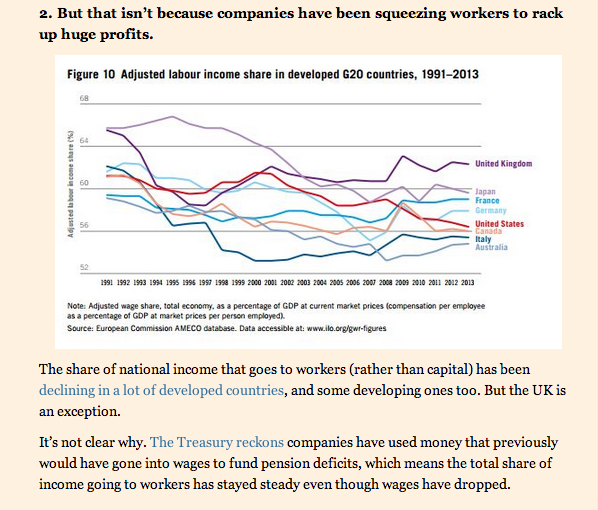

Sarah puzzles over the apparently anomalous fact that the share of national income going to wages appears to be increasing faster than in other countries, while as everyone knows wages have been falling on almost any measure. The chart comes from the compendious International Labour Organisation (ILO) annual Global Wage Report, this year titled “Wages and Income Inequality”.

Well what the Treasury reckons might well be true, but is there anything else that might explain this? I've got two suggestions.

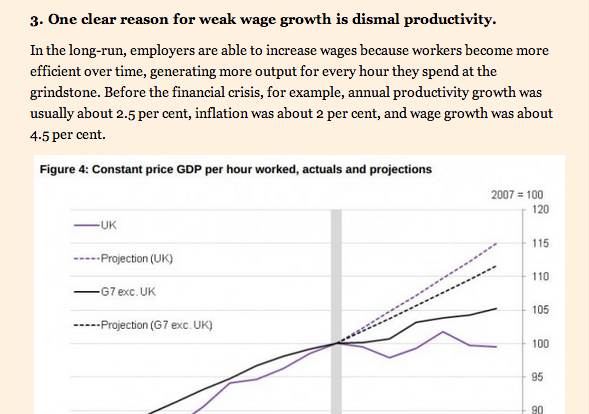

As the ILO report notes, labour income share can decline despite high real wage growth if labour productivity gains are even higher. Naturally, the opposite is also true - the labour income share can grow despite low real wage growth if labour productivity gains are even lower.

As Sarah goes on to note separately the continued weak growth in productivity in the UK (and notes the puzzle about this too), clearly there is at least the possibility of one being a possible factor in causing the other.

Perhaps more significant though is the reliability of the actual data on labour income share for the UK. The ILO rightly explains that income needs to take account of what self-employed people earn as well as the amount paid to employees, with particular reference to the chart used by Sarah.

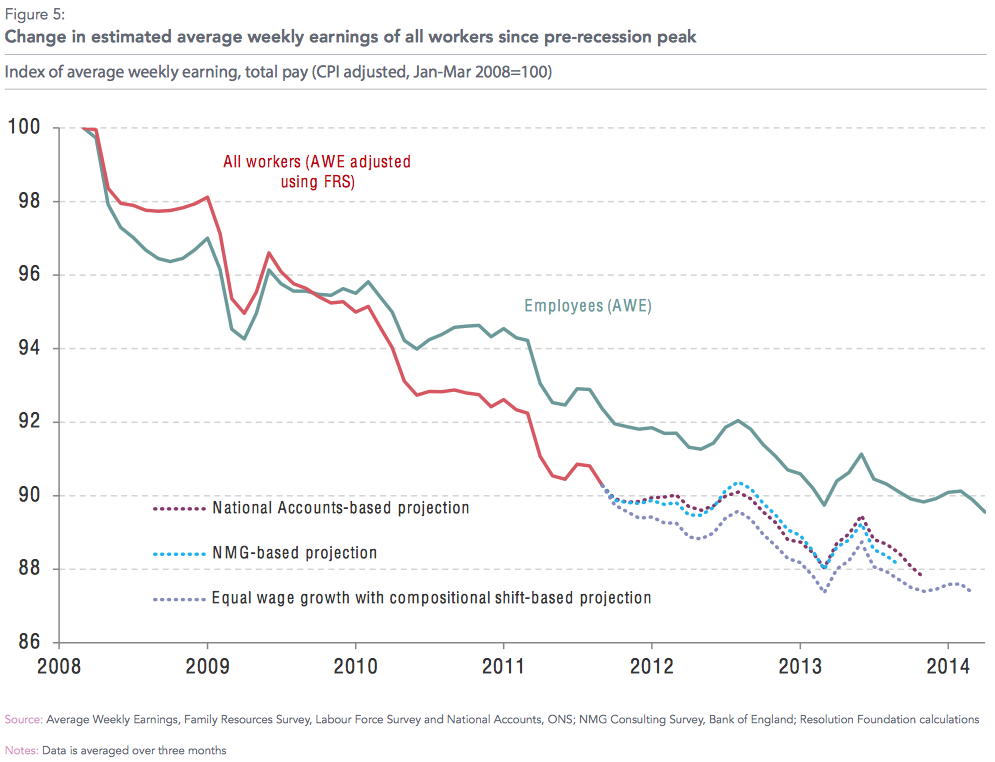

The footnote 15 leads you to a technical appendix in the Global Wages Report from 2010/11 which suggests two different methods for estimating self-employment income. The first of these is simply to assume that self-employed people earn the same on average as employees. The second - slightly more sophisticated is to assume that they earn the same on average as employees in the same industry sector. It is not entirely clear which has been used in the current report, but both methods will give for the UK a quite misleading result, the extensive work by the Resolution Foundation here showing clearly how self-employed income is lower than for employees and how it has fallen further behind in recent years.

Taken together with the increasing proportion of self-employed people in the UK workforce this factor means that data presuming equivalent incomes - whether overall or by sector - will have erroneously boosted the apparent labour share of income for the UK.

Someone with more time and expertise than me might want to do the calculations, but it seems clear that a large part of the divergence of the UK from other countries might well be explained 'methodologically' by falling productivity and 'data-wise' by the overstatement of self-employed earnings...

Contact

prompts and links ...

Jonathan Portes

Writing in Financial World, Jonathan puzzles over the lack of productivity rebound from recession, and wonders whether ground has been lost permanently here.

Morgan Stanley

There are five key drivers of increases in UK self-employment. Overall these suggest the growth derives from weakness in the economy and is a sign of slack. Their report should download here.

Steven Toft (@FlipChartRick)

Increased self-employment doesn't appear to be necessarily a good thing, looked at internationally and macro-economically here

Simon Wren-Lewis

"Why strong UK employment growth could be really bad news" on Mainly Macro here

Ben Chu

Still room for scepticism over this 'glorious recovery' in the Independent here

TUC

The growth of self-employment is part of a trend towards casualised work, likely to hold back wages, and prevent people from having the kind of secure employment they need to pay their bills, save money and plan for the future here